How to get investors for your mobile app startups?

Since the advent of smartphones, mobile app development has become the most popular business idea. More than 90% of the world's population has a smartphone and uses it regularly. With such a vast potential market at your disposal, it is understandable why mobile app development is a thriving industry. However, what could be more understandable is that a few significant players still capture a substantial chunk of this revenue. With such a massive potential at their disposal, it is surprising that mobile app startups need to get their fair share of this revenue.

Your mobile app might be a game changer or a potential unicorn, but you can still raise funds quickly. App developers and mobile app entrepreneurs will face many challenges when raising funds. This blog will help you understand the basics of raising funds for your mobile app startup.

Before you approach app investors with your business idea or app concept, conducting preliminary research is essential. This will help you determine whether your idea is revolutionary and worth investing in. Talk to other entrepreneurs and business professionals, do some online research, and see if your idea has the potential to be a game-changer in your industry. If you can show apps for investors that your concept has the potential to be a significant disruptor, you'll be much more likely to secure funding.

Minimum viable product

An MVP, or minimum viable product, is a great way to get feedback from potential investors on your product or service. By presenting a minimal version of your product, you can gauge interest and get valuable feedback that can help you improve your offering. Additionally, an MVP can help you save on development costs by focusing on the essential features of your product.

To attract investors, you must show them you're serious about your product. This means having a well-thought-out business plan, a solid team in place, and a clear understanding of your target market. Demonstrating your commitment to your product will make you more likely to convince investors to invest in it.

01Types of investors:

The first step to gaining the trust of your investors is to make an excellent first impression. It would be best to articulate your business ideas and plans clearly and confidently. It would be best, to be honest about potential risks and challenges.

Investors are looking for teams that they can trust to execute their vision. So it's essential to show you have the right skills and experience to make your business successful. You must demonstrate that you understand the market and have a solid plan to reach your target customers.

Finally, showing you have the financial backing to make your business a reality would be best. This means having a detailed budget and investment plan. Investors want to see that you have thought carefully about how their money will be used to grow the business.

Following these types of investors, you may find Can give investors the confidence they need to trust and invest in your industry.

Depending on your app idea, the number of funds you need, and the stage you are at, you'll need to look for market investors that offer various ways to get funded. If you have a great app idea but need help getting started, you can look for seed funding from investors. You can look for venture capital if you need more funds to grow your app. And if you're ready to take your app to the next level, you can look for private equity. No matter what stage you're at, there's an investor out there that can help you get the funding you need to succeed.

You may find a few different types of investors when you're looking to raise capital for your business.

Friends and family:

The founders and friends and family fund startups. This initial money is usually enough for the product's first version and essential marketing. If there is a massive demand for the development and it is well positioned on the market, the startup can attract a broader range of investors. Each type of investor is ready to invest in different phases of the startup development cycle.

Friends and family are usually the first ones you will talk to about your idea, and they can be a great source of money at the beginning, but only at the beginning. If you are lucky and your app idea is fantastic, you can get money from friends and family to build a prototype, but you should know that these people will probably not be your primary funding source. To find other sources, consider your company's future needs: Can you cover your expenses by generating revenue? What are your future payments? How much money do you need to launch your product?

Knowing the answers to these questions, you can start looking for a suitable investor.

Equity and debt:

Usually, a startup will require both debt and equity financing to start a project. Debt investors will provide the capital in exchange for a fixed repayment. Equity investors will provide money in exchange for a percentage of the company's ownership, usually in stocks.

Co-founder:

A co-founder is an equal partner in a company with the same amount of shares and shares the same rewards and losses. The founder is someone you ought to share your ups and downs with and should be someone you trust and who can complement your professional and personal life. Having someone, you can go to when you have a problem or run ideas by if you need help coming up with a view on your own is essential. A co-founder is someone who you can work with and who can work with you. While having a successful company with more than one person is possible, it is doubtful. A co-founder is someone you can trust, rely on, and have fun with. A co-founder will be there for you when things are going well and when things are not going well.

App contests:

App contests are all the rage these days. Everyone is trying to create the next big app, but getting a project off the ground can be easier with a dedicated development team. This is where app contests come into play. App contests are a great way to find a dedicated team of developers willing and ready to work on your app idea. These contests can help you find the right people to help you to turn your app idea into a reality.

Crowdfunding:

Crowdfunding is a term used to describe a collaborative effort between multiple people over the internet. You may have heard about crowdfunding for startups, but it can be used for all sorts of things, from funding a new business venture to raising money for a trip to space. There are multiple types of crowdfunding, the most popular being rewards-based and equity-based. Rewards-based crowdfunding is when you incentivize people to donate to your project. With equity-based crowdfunding, you are giving away a stake in your company.

Angel investors:

They are usually wealthy individuals looking to invest in high-growth companies. They typically invest smaller sums of money than venture capitalists but are also more hands-off regarding the business's day-to-day operations.

Venture capitalist:

Venture capitalists are typically firms or individuals who invest considerable sums of money into companies with high growth potential. They often take a more active role in the business and may even sit on the board of directors.

Strategic investor.

Strategic investors are typically companies investing in businesses in the same industry as them. They're looking to invest in companies that can help them expand their market share or give them a competitive edge.

So, you may encounter a few different types of investors when you're looking to raise capital for your business. It's important to know what each type of investor is looking for so that you can pitch your business in the right way.

02How to win over investors to fund the development of mobile apps

The critical actions listed below will assist you in gaining the confidence of investors and raising money for your innovative idea:

Validate your idea:

If you're looking to raise money for your next app, you need a clear idea of what your product will do, who your market is, and how you will reach them. Because investors are always looking for potential opportunities, with the sheer number of applications, it's hard to decide which ones are worth their time. But it would be best to validate your app idea before you can even reach out to investors.

Find the right market:

Finding the right market is crucial to raising funds for your creative idea. If you spend time and money developing a mobile application nobody wants or needs, you'll hardly earn any profit. You could end up in a situation where you'll need to start from the beginning and work on another idea. Begin your early research by investigating the market, discovering what companies are already doing in that area, and the possible ideas. You can move on to the next step when you have a clearer picture of your target market.

Define the market size:

When you start creating any new business, it's always important to look at the market size or the potential of that market. If you can create a business plan that includes the financial data of that market, you'll be in a better position to attract potential investors. The more information you share with them, the more confidence they will have in you, and the better your chances of getting that investment.

Choose a reliable app development partner:

Your app idea has won the hearts of developers and investors alike. You should start raising funds to turn it into an actual product. Now, you might be thinking of approaching a bank. But before you do that, you must take a leaf out of the playbook. Instead of approaching a bank, you should look for an app development partner to help you develop your idea. After all, apps are the future. Just look at the emergence of chatbots. You don't need to hire an army of developers to get your app idea. A reliable app development partner will help you in every step of the app development process.

Know the investment basics:

As an entrepreneur, it is essential to learn the basics of raising investment capital before you get too far into your project. The most important thing to understand about raising investment capital is to build trust with your audience before raising funds. If you establish credibility, you can remember raising capital from investors. The first thing you need to do is create a solid business plan. You need to explain to investors how your business will make money and how it will change the world. You want to show that you have a good idea and have thought it through. It is essential to explain how you will spend the money and how you will pay it back. Finally, you need to tell investors what kind of return they can expect.

Figure out revenue strategy:

Raising funds for your mobile app is a serious business. You have to give your best shot, which involves having a good plan for the future of your application and the startup business in general. Nonetheless, what matters here is how you present your case. You need to start working on your pitch to secure the necessary funding. To raise funds for your mobile app, you must know how to present, convince, and prove that you are a reliable partner who will deliver the product. An investor will only invest in development with good profit potential. Investors like to invest in startups with great ideas and a sound plan for their implementation.

Create MVP:

"MVP" stands for "minimum viable product," which is fundamental when getting funding for your creative idea. In the world of startups, MVP is the first version of your product or app that you release to gauge how users will react. Creating an MVP is a great way to secure funding for your startup because investors like to see progress before they invest. They want to know that your company can deliver. Creating an MVP is more than enough evidence to prove that because it shows that you are taking your idea seriously and working toward a result.

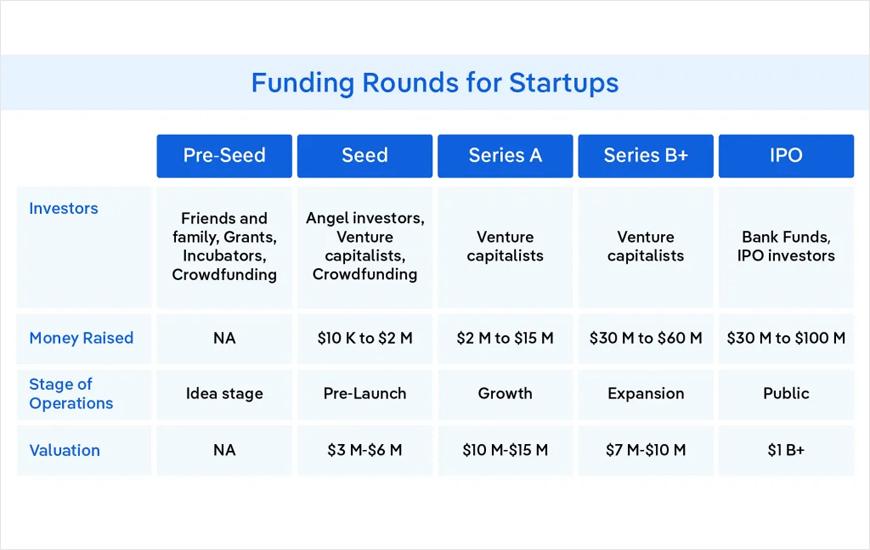

03After learning how to get investors for an app, let's talk about the different stages of startup fundraising.

Pre-seed funding:

Raising pre-seed money is a lot more challenging than it sounds. Most early-stage investors want traction, an excellent founding team, and a proof of concept. The main reason they are looking to invest at this stage is that they want to help you grow – and they want you to have a strong chance of success. If you don't have a great idea, the right people, and a plan to grow your business, you're probably better off waiting for the next stage. The good thing is that if you have some traction and are making good progress and generating revenue, you might be able to raise money at this stage.

Seed stage:

Seed funding is a type of early-stage investment in a startup company. Angel investors and venture capitalists typically provide it. Seed funding is generally the first stage of venture funding or investment in exchange for an equity stake in the company. It can be provided in several ways but is most commonly offered as convertible debt or ownership equity.

Series B, C, D, etc.:

It's a new idea and a gamble. You're a startup if you're raising a seed round or a Series A. You're offering something new, and the market is responding well. You've got a happy customer base, and now you want to improve on what you've got. That's why you're looking at Series B and beyond. That's when you're making a name for yourself.

04How to pitch your app idea to investors

If you're looking to pitch your app idea to investors, there are a few things you'll need to keep in mind.

- First, you'll need a well-thought-out, detailed business plan outlining your app's development, marketing, and monetization strategy.

- Second, you'll need to be able to articulate your app's value proposition and unique selling points.

- Third, you'll need to have a solid understanding of the competitive landscape.

To give your pitch the best chance of success, do your homework and come prepared with answers to any questions investors may have. Be confident but not arrogant, and highlight your app's potential return on investment. If you can do all this, you'll be well on securing the funding you need to bring your app to life.

05 How much funding do you need for your app startup?

There is no simple answer to this question - it depends on several factors, including the size and scope of your app, the platform you're developing for, and the features you plan to include. A rough estimate is that you'll need to raise somewhere between $50,000 and $250,000 to get your app startup off the ground.

Of course, this is a ballpark figure - depending on your specific circumstances, you may need more or less. But this is an excellent place to start if you want to raise funding for your app startup.

Remember, the funding you need will also depend on how much you're willing to invest yourself. If you're putting up some of your money, you'll need to raise less from outside investors. So it's essential to factor that in as well when you're estimating your funding needs.

Ultimately, there's no magic number regarding how much funding you need for your app startup. It all depends on your specific situation. But if you're looking to raise money from investors, an excellent place to start is by estimating that you'll need to present somewhere between $50,000 and $250,000.

06 What to do once your app gets funding?

Once you've secured funding for your app, it's time to start turning your vision into reality.

The first step is to assemble a team of developers who can bring your app to life. Don't skimp on this step – a good development team will be critical to your app's success.

Next, you'll need to create a detailed roadmap for your app. This roadmap should include everything from the initial development to ongoing maintenance and updates. Include milestones and deadlines in your roadmap to track your progress and keep your team on track.

Finally, you'll need to start marketing your app. This includes everything from creating a buzz on social media to submitting your app to app store directories. Ensure you have a solid marketing plan to get your app in front of as many potential users as possible.

07 How to find investors for startups in India?

There are several ways to find Top investors in India for app startups.

One way is to attend startup events and meetups. This is a great way to meet potential investors and get your foot in the door.

Another way is to use online platforms. These platforms allow you to connect with investors and pitch your startup.

Finally, you can also use personal connections to reach potential investors.

This could include family, friends, and acquaintances. If you have a strong business idea and a solid pitch, you should be able to find investors for your app startup in India.

Have an Idea?

Let's Discuss Your Project

Have an Idea?

Let's Discuss Your Project

& What you will get:

- On-call inquiry assistance

- Project consulting by experts

- Detailed project estimation